Here’s why analysts are turning bullish on ADA

![]() Cryptocurrency Nov 20, 2024 Share

Cryptocurrency Nov 20, 2024 Share

Cardano (ADA) is gearing up for a potential breakout as renewed optimism in the market propels the asset toward critical resistance levels.

Currently trading at $0.84, ADA has broken out of a bullish pennant pattern, with price action approaching a decisive point, as highlighted by analyst Av_Sebastian in a recent X post dated November 20.

Technical analysis: Key levels and patterns

According to the analysis, Cardano’s breakout from a bullish pennant pattern indicates strong upward momentum, driven by rising trading volume and an RSI nearing overbought levels.

Picks for you

This is the ‘easiest and surest’ 10x to 30x play in crypto, says investor 9 mins ago Expert outlines Bitcoin's path to $135,000 in December 41 mins ago AI predicts Ethereum (ETH) price for year-end 2 hours ago What next for gold as bears set to 'provoke further decline' 2 hours ago  Cardano price analysis chart. Source: Av_Sebastian/TradingView

Cardano price analysis chart. Source: Av_Sebastian/TradingView

The next critical resistance lies at $0.91, aligning with the measured move projected from the breakout pattern. Should the rally persist, $0.85 may flip from resistance to support, further solidifying ADA’s bullish stance.

On the downside, $0.70 now acts as a significant support level after being flipped from resistance, with additional cushions at $0.80 and $0.65. These levels provide a roadmap for potential retracements or further gains, highlighting ADA’s bullish trajectory.

Whale accumulation boosts confidence

Adding to the bullish sentiment, Cardano whales have significantly increased their accumulation, showcasing growing confidence in the asset’s long-term potential.

Analyst Ali Martinez recently shared data from IntoTheBlock, revealing that wallets holding over $10 million worth of ADA have expanded their positions by an impressive 145.72%, now accounting for $12.11 billion.

#Cardano whales have been actively accumulating $ADA over the past month, with holders of over $10 million in #ADA increasing their positions by 145.72%! pic.twitter.com/a7v39zktuJ

— Ali (@ali_charts) November 20, 2024

Similarly, mid-sized wallets holding between $1 million and $10 million have grown by 82.97%, reaching $3.9 billion, while smaller institutional wallets in the $100,000 to $1 million range saw a 105.66% increase, totaling $4.36 billion.

In sharp contrast, smaller holders have reduced their positions, signaling a shift in ADA’s supply toward larger investors. This consolidation underscores rising institutional confidence and a robust outlook for Cardano’s future growth.

Derivatives market shows strong bullish sentiment

Data from CoinGlass highlights a surge in ADA futures, with open interest rising by 24.56% to $757.16 million.

This is accompanied by a 114.65% jump in trading volume, reaching $3.21 billion, reflecting heightened market activity. Long/short ratios on Binance and OKX show a clear preference for long positions, reinforcing expectations for upward price movement.

Additionally, short liquidations totaling $4.32 million, compared to $2.35 million in long liquidations, show significant pressure on bearish positions.

On-Chain metrics support continued growth

Santiment data further strengthens the bullish outlook for ADA. Cardano’s daily trading volume has reached a seven-month high of $52.26 billion, while whale transactions have surpassed 8,900 for two consecutive weeks, a level not seen in six months.

ADA on-chain activity. Source: Santiment

ADA on-chain activity. Source: Santiment

ADA’s price ratio against Bitcoin (BTC) is approaching an eight-month high, reflecting its strong relative performance. Historically, such metrics preceded a 26% rise in the ADA/BTC pair, suggesting the potential for continued bullish momentum.

Cardano price analysis

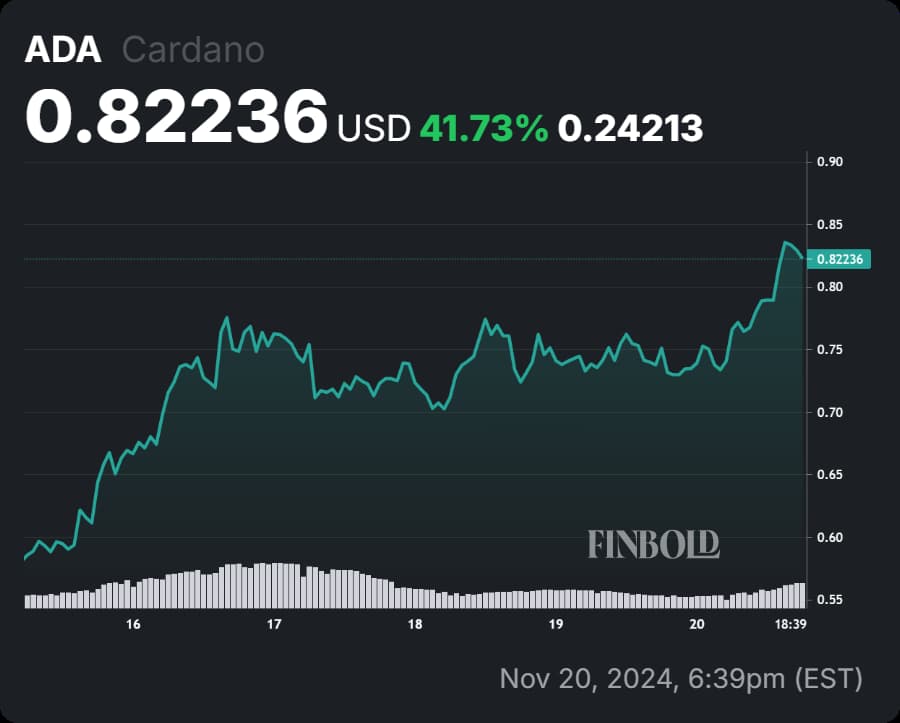

At the time of writing, ADA is trading at $0.84, reflecting a 13% gain in 24 hours and 55% over the past week. The token has also experienced substantial growth in the last month, surging by 132%.

ADA seven-day price chart. Source: Finbold

ADA seven-day price chart. Source: Finbold

With ADA decoupling from the broader altcoin market and approaching key resistance levels, analysts are increasingly confident in its upward trajectory. These technical and fundamental signals collectively point to a promising outlook for Cardano in the near term.

Featured image via Shutterstock