Synopsis

Bitcoin and Ethereum prices surged amidst growing interest and ETF approvals. CleanSpark’s acquisition and SEC’s ETF approvals signal positive trends in crypto investments. VanEck filed for a Solana ETF, further expanding the investment options in the market.

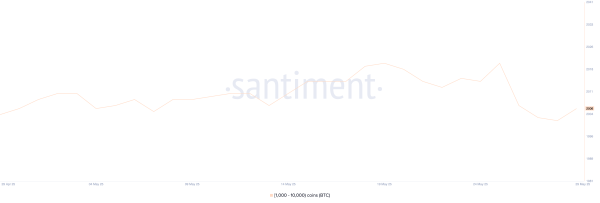

Bitcoin (BTC) traded in the green on Friday around 12 pm taking a 1.5% lead as buying interest returned on this crypto asset. It was hovering near the $61,500 mark. BTC also managed to breach the $62,000 level in the last 24 hours.

Other major crypto coins were also trading with a positive bias including Ethereum (ETH), BNB, Solana, XRP, Toncoin, Dogecoin, Cardano, Avalanche and Shiba Inu which were up by 9% around this time.

Among the altcoins that were trading in the red were Tether and Tron which were down by over 1%.

Crypto Tracker![]() TOP COIN SETSWeb3 Tracker6.56% BuyDeFi Tracker5.19% BuyAI Tracker4.31% BuyNFT & Metaverse Tracker2.70% BuyCrypto Blue Chip – 51.04% BuyTOP COINS (₹) Bitcoin5,140,095 (1.22%)BuySolana11,959 (1.04%)BuyBNB48,090 (1.03%)BuyEthereum283,999 (0.68%)BuyTether83 (-0.07%)BuyCommenting on the action, Edul Patel, CEO of Mudrex said that BTC breaching the $62,000 mark was on the back of investors flocking back to spot Bitcoin ETFs and an increase in the USA’s real GDP. He sees the next hurdle for BTC at $62,700, with support around $61,400.

TOP COIN SETSWeb3 Tracker6.56% BuyDeFi Tracker5.19% BuyAI Tracker4.31% BuyNFT & Metaverse Tracker2.70% BuyCrypto Blue Chip – 51.04% BuyTOP COINS (₹) Bitcoin5,140,095 (1.22%)BuySolana11,959 (1.04%)BuyBNB48,090 (1.03%)BuyEthereum283,999 (0.68%)BuyTether83 (-0.07%)BuyCommenting on the action, Edul Patel, CEO of Mudrex said that BTC breaching the $62,000 mark was on the back of investors flocking back to spot Bitcoin ETFs and an increase in the USA’s real GDP. He sees the next hurdle for BTC at $62,700, with support around $61,400.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »“Bulls are actively buying at these support levels,” he added.

Source: CoinMarketCap

Patel – Meanwhile, Ethereum saw a 3% rise, anticipating the spot Ether ETF approval by July 4th. Solana also jumped 9% following VanEck’s filing for a Solana ETF.

Another important development was in the Bitcoin mining sector, where CleanSpark announced an all-stock acquisition of GRIID Infrastructure valued at $155 million. “Following the news, GRIID’s shares plummeted by over 50%, while CleanSpark’s shares saw a nearly 4% increase, indicating the market views the acquisition as a distressed sale. This deal comes amid heightened M&A activity in the bitcoin mining industry post-halving,” a CoinSwitch Markets Desk note said.

It also noted the lack of crypto mentions in the first general debate of the 2024 US Presidential election. The discussion was around technology policy, leaving the digital assets industry out of the spotlight, CoinSwitch Markets Desk commented.

Meanwhile, asset manager VanEck’s filing for the first Solana (SOL) ETF in the US sparked-off a 6% surge in its price, pushing it to $148. This follows closely on the heels of a similar Solana ETF launch in Canada just six days prior.

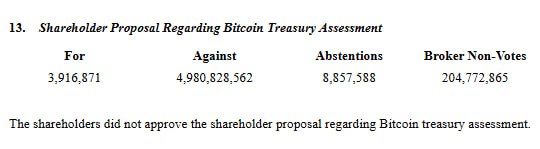

The SEC’s approval of the first spot Bitcoin ETF and the anticipated approval of an Ether ETF signal a growing trend in crypto investment products. ETH ETFs could draw $5 billion within the first five months, according to estimates by analysts.

Avinash Shekhar, Co-founder & CEO, Pi42 attributed the current volatility in Bitcoin and other altcoins to price consolidation.

He also mentioned the growing interest in ETH ETFs post the BTC ETF which he had anticipated could trigger an 8% uptick. It was trading up by 7% at $144.98 around this time.

His advice to investors is to keep a watch as several research firms, including Galaxy Research predict that the ETH ETF could see $1B of net inflow a month and $5B in the first five months.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)